Abstract

Innovation ecosystems are formed by interconnected firms that coalesce in interdependent networks to jointly create value. Such ecosystems rely on the norm of reciprocity—the give-and-take ethos of sharing knowledge-based resources. It is well established that an ecosystem firm can increase its competitive advantage by increasing interconnectedness with partners. However, much research has focused heavily on the positive role of inbound openness or ‘taking’ resources from ecosystem partners. The positive role of outbound openness or ‘giving’ resources to ecosystem partners remained less explored and often misunderstood as eroding competitive advantage. We address this gap by first developing a conceptual model about the mediating role of inbound openness and outbound openness in the relationship between a firm’s ecosystem interconnectedness and competitive advantage. We then test this model on a large sample (n = 794 managers) from Silicon Valley (USA) and Macquarie Business Park (Australia). Results indicate that outbound openness is a more important mediator than inbound openness for ecosystem firms seeking competitive advantage. Our findings suggest that the effect of outbound openness goes beyond merely generating tit-for-tat reciprocity to generating strategic benefits in their own right. The study adds to knowledge about the ethics of innovation ecosystems by showing that outbound openness to partners improves competitive advantage. Ecosystem firms, thus, do well by doing good when they increase their outbound openness.

Similar content being viewed by others

Introduction

If you don't focus on the needs of your partners, your ecosystem will wither on the vine, no matter how strong your brand and market position; chances are that some other ecosystem builder can offer a better alternative (Jacobides, 2019, p. 128).

Values and ethical behavior are foundations of all social systems, including innovation ecosystems—“the collaborative arrangements through which firms combine their individual offerings into a coherent, customer-facing solution” (Adner, 2006, p. 2). Innovation ecosystems are social architectures for innovation among interdependent firms interconnected through value-adding networks and alliances (Adner, 2017; Alam et al., 2022b; Davis, 2016; Jacobides, 2019). While leading examples tend to come from high-tech settings (e.g., Apple’s macOS, Lenovo’s Yoga, think Intel, Cisco, and Nokia), firms in other industries increasingly form innovation ecosystems to develop and commercialize coherent customer-facing solutions such as Boeing 787 Dreamliner, Michelin’s PAX Run-Flat Tire, Toyota’s hybrid, and Optus 5G. Multiple big and small interconnected firms within an innovation ecosystem (henceforward, ecosystem firms) engage in open innovation activities to develop new products and services (Brattström & Faems, 2020; Xie & Wang, 2020). Open innovation activities involve “the use of purposive inflows and outflows of knowledge to accelerate internal innovation and expand the markets for external use of innovation, respectively” (Chesbrough, 2006, p. 1). Enabled by information technologies that significantly reduce coordination costs, connectedness with ecosystem partners is a core element of open innovation. Ecosystem interconnectedness—the firm’s level of interdependence and integration within an ecosystem—allows ecosystem firms to align their interdependencies and integrate ecosystem resources to drive open innovation and gain competitive advantage (Adner, 2017; Bogers et al., 2018; Jacobides et al., 2018; Xie & Wang, 2020).

The role of ethics grows significantly with the adoption of open innovation among interconnected ecosystem firms. Indeed, the ‘open’ part of innovation strategy carries with it an implicit set of ethical behaviors that shape the extent to which firms share knowledge-based resources. Research shows that innovation success relies heavily on a give-and-take ethos or reciprocity (Alam et al., 2022a; Grant, 2013). Many others highlight openness as a catalyst for developing inter-firm trust, facilitating reciprocity (Davis, 2016; Knockaert et al., 2019). Therefore, the way openness is understood in ecosystems can significantly influence the economic behavior of its participants. It is well established that an ecosystem firm can increase competitive advantage by increasing its interconnectedness with other partners (Benitez et al., 2020; Dattée et al., 2018; Fasnacht, 2018; Knockaert et al., 2019). Literature suggests that increased interconnectedness between ecosystem firms enhances the propensity of knowledge inflow or inbound openness—getting needed resources from other ecosystem firms (Adner, 2017; Chesbrough et al., 2018; Jacobides, 2019). Scholars also agree that increased interconnectedness can facilitate knowledge outflow or outbound openness—giving resources to other ecosystem firms (Dahl & Pedersen, 2004; Lundmark & Klofsten, 2014). As firms become more interconnected, their employees create formal and informal networks that facilitate knowledge flows in both directions (Dahl & Pedersen, 2004; Lundmark & Klofsten, 2014; Tomlinson, 2010). Thus, by increasing ecosystem interconnectedness, a focal firm can expect to increase both inbound and outbound openness, eventually translating into competitive advantage. While there is consensus that inbound openness is positively related to an ecosystem firm’s competitive advantage, the corresponding effect of outbound openness is debated. The role of outbound openness in the relationship between a firm’s ecosystem interconnectedness and competitive advantage remains unclear. Compared to inbound, the outbound openness dimension is “less explored and hence less well understood, both in academic research and also in industry practice” (Bogers et al., 2018, p. 7; See also Chesbrough et al., 2018).

Much strategy research dissuades outbound openness based on assumptions that it erodes competitive advantage. For example, some noted that “whatever is open may be imitated, and any resource that is imitable will soon be less rare” (Alexy et al., 2018, p. 1707). Also, ceding resources amounts to forfeiting control, leaving the focal firm with less freedom to appropriate value (Boudreau, 2010; Henkel et al., 2014). Furthermore, some claim that opening a product, patent, or innovation procedure will require working with partners that will increase coordination costs and generate suboptimal private returns (Almirall & Casadesus-Masanell, 2010). In contrast, scholars researching interdependent context frame outbound openness as a matter of reciprocity (Davis, 2016; Grant, 2013; Narasimhan et al., 2009). In principle, resource sharing in innovation ecosystems should be reciprocal, i.e., for a firm to have access to resources, it needs to give some of its own resources to create reciprocal ceding from other ecosystem firms (Benitez et al., 2020; Blau, 1964; Bogers et al., 2018; Flynn, 2003; Flynn & Yu, 2021; Jacobides, 2019; Jakobsen, 2020; Narasimhan et al., 2009; Rooney, 2015).

Business ethics researchers have attempted to extend this perspective beyond tit-for-tat or purely instrumental reciprocity by suggesting a positive role of generosity—openness to ceding resources beyond what is required for reciprocation (e.g., Harvey et al., 2021; Rhodes & Westwood, 2016; Rooney, 2015; Zoogah & Zoogah, 2020). Studies in this vein argue that a firm encourages the process or reciprocal obligation by being generous in the exchange relationship, thus creating a virtuous cycle (Grant, 2013; Gustafsson, 2005; Kathan et al., 2015). Of course, outbound openness necessarily benefits the takers (receiving ecosystem firms) and giving above and beyond the minimum required to obtain external resources would be a matter of altruism, in the sense of inflicting a cost to oneself to benefit others (Phelps, 1975). Notably, the broader business literature often frames stakeholder management as a matter of maximizing what one gets, while minimizing what one must give to do well (Fassin, 2012; Friedman, 2007). Thus, a tension exists between the ideas that, on the one hand, firms should focus on their own interests, and on the other, that giving more than required is not only virtuous but can also lead to long-term benefits for the giver.

This study examines whether ecosystem firms do well by doing good, in the sense of generously ceding resources to partner firms. In this way, we are linked to the literature that argues that doing good and well should be addressed in a firm’s interactions with all its stakeholders because firms and their stakeholders are interdependent (Meyer, 2015; Porter & Kramer, 2011; Sacconi, 2007). We first theorize a conceptual model to explain the mediating role of inbound openness and outbound openness in the relationship between a firm’s ecosystem interconnectedness and its competitive advantage. We then empirically test the model in two innovation hubs, using survey data of 794 managers, including n = 370 from Silicon Valley, USA, and n = 424 from Macquarie business Park, Australia. Results validate our hypotheses that outbound openness positively mediates the relationship between ecosystem interconnectedness and competitive advantage. Furthermore, our analysis indicates that outbound openness is a more important mediator than inbound openness for ecosystem firms seeking competitive advantage by increasing their ecosystem interconnectedness. The study contributes to research on ethical culture and innovation ecosystems by showing that even when controlling for reciprocity (i.e., the effects of outbound openness on inbound openness), outbound openness augments (rather than erodes) the competitive advantage of an ecosystem firm. We discuss our findings in light of business ethics, informing managers and policymakers about how firms can be better off sharing knowledge resources more generously with ecosystem partners. Finally, we discuss the theoretical and practical implications and highlight new directions for future research.

Theoretical Background

In this section, we synthesize extant literature to first describe the interconnected context of an innovation ecosystem involving interdependent and integrated activities and then examine the relationship that interdependence and integration have with competitive advantage. In particular, we theorize the manner in which ecosystem firms’ inbound openness and outbound openness may have a mediating effect on the relationships between ecosystem interconnectedness and competitive advantage and postulate testable hypotheses.

Innovation Ecosystem

The biological metaphor “ecosystem” has been adopted in innovation studies to explain the increasing propensity of interdependent economic entities working across their traditional operating boundaries. When a firm does not have all the resources including knowledge, capabilities, and processes to innovate complex, customized, and integrated products, it makes sense for it to depend on other firms that do have those resources (Davis, 2016; Pfeffer & Salancik, 1978). Moreover, a resource-dependent firm may form a web of partnerships, strategic alliances, and networks with other firms across industries, and also with governments, universities, and customers to access useful resources, thereby creating an innovation ecosystem (Adner, 2006; Bogers et al., 2018; Dattée, et al., 2018; Knockaert et al., 2019; Xie & Wang, 2020). Innovation ecosystems not only help the founding firm that holds a focal position and therefore needs to exercise its positional power wisely (Adner, 2017; Iansiti & Levien, 2004; Jacobides et al., 2018); these ecosystems also create new value for all members including complement providers and end customers (Adner, 2017; Alam et al., 2022a; Brattström & Faems, 2020). Regardless of their role, size, and power, it is widely accepted that interdependence and integration among ecosystem firms are positively linked to their competitive advantage.

Given the expansiveness and heterogeneity of actors involved, extant literature offers many views of what innovation ecosystems are, and how ecosystem firms’ interdependence and integrated activities translate into competitive advantage. For example, Adner (2017) proposed two approaches to conceptualizing innovation ecosystems; first, “ecosystem as structure” and, second, “ecosystems as affiliation,” both of which comprises an array of multilateral partners that must interact with each other to materialize a focal value proposition. Jacobides et al., (2018) adopted a platform perspective in which firms (providers of complementary innovations, products, or services) who might belong to different industries and need not be bound by contractual arrangements, collaborate due to significant interdependence. Others adopt a combination of these and other perspectives to discuss the types of ecosystems (e.g., business, entrepreneurial, and platform), partner firms (i.e., keystone or hub firm and complement providers), and use different names such as value network, maker spaces, multi-sided market (Jacobides et al., 2018), and relationship structure (See, e.g., Alam et al., 2022a; Bogers et al., 2018; Brattström & Faems, 2020; Chesbrough et al., 2018; Dattée et al., 2018; Reynolds & Uygun, 2018; Xie & Wang, 2020).

A common assumption is that alignment of interdependencies and integration of innovation resources and activities enable ecosystem firms to jointly create value in a way that none of the actors would be able to do in isolation. Bogers et al., (2019, p. 2), therefore, define an innovation ecosystem as “an interdependent network of actors that jointly create value.” Given that joint value creation necessitates the give and take of productive resources, reciprocity is a fundamental feature of an ecosystem firm. This premise also implies that ethical behavior based on appropriate social values plays a vital role in the functioning of such innovation ecologies.

Ethics and Reciprocity in Collective Work Behavior

The links between virtues, such as generosity, with economic activity, generally, are important and have been investigated in the business ethics literature (Harvey et al., 2021; Rhodes & Westwood, 2016; Rooney, 2015; Zoogah & Zoogah, 2020), but less so in the context of innovation ecosystems. A good starting point for understanding ethical virtue in an innovation ecosystem is through Aristotle’s virtue ethics. Virtues are embodied “characteristics that are intermediate between extremes and always belong in the mean” (Riivari & Lämsä, 2019: 3) that shape social behavior. Thus, a reasonable “just right” level of ethical virtues at the individual and organizational level is needed for a virtuous organization or ecosystem. Building on previous research (Mingers, 2011; Riivari & Lämsä, 2019; Tseng & Fan, 2011), our Aristotelian understandings of ethics in ecosystem strategy is that virtue ethics are not pre-existing universal and absolute standards. Rather, ethics are based on the culture, climate, and shared assumptions in an environment where the creation and commercialization of new ideas is a central purpose (Riivari & Lämsä, 2019). Virtue also requires excellent ethical reasoning and the ability to translate that reasoning into social action. An ethical business climate, therefore, mirrors employees’ perceptions of their corporation’s virtuous practices (Chun et al., 2013) and the ability of individuals and groups to reason and act virtuously, and this should also hold for networks of interacting firms. In the case of innovation ecosystems, practices might be unethical if, for example, the focus of a collaborator is on ruthless exploitation of network firms, rather than on seeking to fairly acknowledge others for their intellectual contribution.

Ethical beliefs are reflected in the policies and practices that shape managers’ decisions and strategies (McCubbrey, 2009), and actions. This is also the case in open innovation strategies that regulate intellectual assets within and among innovating firms (Pučėtaitė et al., 2016; Riivari & Lämsä, 2014, 2019; Su, 2014). Given the importance of inbound and outbound openness in innovation ecosystems, how we understand these facets of openness has implications for how we frame the ethics of knowledge sharing. Research shows that ethics is a key factor in building a trusting ecology for innovation (Blok & Lemmens, 2015; Riivari & Lämsä, 2019; Su, 2014). Moreover, research (Rechberg & Syed, 2013; Tseng & Fan, 2011; Williamson, 1985) indicates several ethical problems such as opportunism, conflict of ownership, and power imbalance impedes collaborative inter-firm innovation. However, beyond these imperatives is the ability to know what is the right thing to do and how to do it, which is fundamental to being virtuous and that goes beyond instrumental give and take to generosity and virtue more generally (Rooney et al., 2010).

Empirical studies increasingly document the benefits of ethical climate or culture in fostering open innovation. For example, Su (2014) reports that ethics are at the core of business processes by contributing to building a trustworthy culture that encourages open communication, knowledge sharing, and problem solving along the whole value chain. Similarly, other researchers (e.g., Pučėtaitė et al., 2016; Riivari & Lämsä, 2014; Youndt et al., 2004) found that ethical behavior enhances firms’ social and intellectual capital, and such ethical climate stimulates innovativeness. Specifically, Riivari and Lämsä (2019) showed that ethical culture enhances innovativeness in several ways, such as inspiring the creation of an open, just, and cooperative culture, which leads to better idea sharing, positive employee self-evaluation, and greater attachment with their organization. In effect, ethics encourages collaboration, sharing, and transparency that creates social capital in the form of trust, and thereby stimulates successful open innovation (Blok & Lemmens, 2015; Riivari & Lämsä, 2019; Su, 2014).

Ecosystem Interconnectedness and Competitive Advantage

Innovation research suggests that ecosystem firms create superior products and hence competitive advantage because ecosystems help them align multilateral interdependence and integrate innovation resources and activities (Adner, 2017; Dattée et al., 2018; Jacobides et al., 2018; Knockaert et al., 2019). In this regard, the degree of interdependence and integration can be used as proxies for the degree to which ecosystems are interconnected. Interdependence is the extent to which firms depend on each other’s resources (Davis, 2016; Pfeffer & Salancik, 1978), and integration is the extent to which multiple firms work together using coordinated routines to facilitate the exchange of resources (Pablo, 1994). Although resources may include “all assets, capabilities, organizational processes, firm attributes, information, knowledge, etc.” (Barney, 1991, p. 101), we focus on sharing intangible resources (primarily knowledge, but also licenses, patents, and trademarks) since they are often more critical to ecosystem firms’ innovation and competitive advantage (Alexy et al., 2018; Clarke & MacDonald, 2019; Das & Teng, 2000).

Interdependence can make firms vulnerable to unethical actions committed by fellow ecosystem members. However, as Blau (1964) and Emerson (1976) theorize, social interaction as an action–reaction system of rewards that specifically develop trust and reciprocity, and in the process foster generosity by reducing the giving party's sense of vulnerability. Ecosystem interconnectedness is, therefore, specifically based on expectations of safely constructed mutual benefits from exchanges of value that also generate social and ethical obligations between ecosystem firms (Benitez et al., 2020; Knockaert et al., 2019). In this kind of ethical climate, an ecosystem and its individual members become better at reasoning about and aligning multilateral interdependencies and integrating heterogeneous knowledge resources (Knockaert et al., 2019), increasing their capacity to “recognize the value of new, external information, assimilate it, and apply it to commercial ends” (Cohen & Levinthal, 1990, p. 128). Many projects that would otherwise sit idle on a shelf due to a lack of resources flourish from the safe give and take of resources. Resource sharing allows ecosystem firms “to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments” (Teece et al., 1997, p. 516). Consequently, firms make greater use of both external and internal resources to respond to market needs and efficiently innovate superior products and services.

Hypothesis Development

The purpose of our study is to understand the mechanisms underpinning a known relationship between ecosystem interconnectedness and competitive advantage via the inclusion of a third variable (two shades of openness). The general line of argument that competitive advantage relies upon the notion of inter-firm openness serves as our starting point for theorization. In line with the purpose of the study (to explain the how part of the puzzle), we postulate mediation hypotheses. Mediation analysis helps to identify and explain the mechanism or process that underlies an observed relationship and how external events take on internal psychological significance (e.g., Baron & Kenny, 1986; MacKinnon et al., 2007).

Inbound Openness as a Mediator Between Ecosystem Interconnectedness and Competitive Advantage

Part of the reason why ecosystem connectedness promotes competitive advantage is that it enhances inbound openness, i.e., a firm’s tendency to allow the inflow of resources, including knowledge and other intangible resources such as patents, licenses, and trademarks from ecosystem partners (Cheng & Huizingh, 2014; Vanhaverbeke et al., 2017). Ecosystem firms obtain needed resources through inbound openness by opening their boundaries to draw from ecosystem partners like research institutes, suppliers, customers, universities, governments, and competitors (Bogers et al., 2018; Cheng & Huizingh, 2014; Chesbrough et al., 2018). Both traditional and contemporary innovation strategies acknowledge the positive role of inbound openness on competitive advantage (Alexy et al., 2018; Hannah & Eisenhardt, 2018; Kapoor & Lee, 2013; Knockaert et al., 2019; Xie & Wang, 2020). Inbound openness is amplified for ecosystem firms because a central reason for ecosystem interconnectedness is access to productive resources. Therefore, the role of inbound openness as a mediator between ecosystem interconnectedness and competitive advantage is well established, but it is included here to test previous theorizing (Jacobides et al., 2018, Zaheer et al., 2013; Knockaert et al., 2019; Chesbrough et al., 2018; Pemartín et al., 2018). High levels of ecosystem interconnectedness—performing interdependent innovation activities and integrating knowledge resources—are positively related to the level of inbound openness. Inbound openness, in turn, will facilitate the acquisition of external knowledge resources, which will lead to improved products, and ultimately strengthen a firm’s competitive advantage. In other words, inbound openness is a mediator between a firm’s level of ecosystem interconnectedness and the firm’s competitive advantage. Stated formally:

Hypothesis 1

An ecosystem firm’s inbound openness mediates the positive relationship between interdependence and competitive advantage.

Hypothesis 2

An ecosystem firm’s inbound openness mediates the positive relationship between integration and competitive advantage.

Outbound Openness as a Mediator Between Ecosystem Interconnectedness and Competitive Advantage

Another reason why ecosystem connectedness promotes competitive advantage is that it facilitates outbound openness, i.e., a firm’s tendency to allow the outflow of knowledge and other outbound resources. Recent theorizing highlights the benefits of outbound openness for ecosystem firms (Alexy et al., 2018; Bogers et al., 2018; Chesbrough et al., 2018), but such theorizing is yet to be tested quantitatively. In the following, we theorize why outbound openness is a fundamental mediator in the relationship between ecosystem interconnectedness and competitive advantage.

First, the standard and perhaps most established argument for outbound openness is that it cultivates reciprocity (Blau, 1964; Emerson, 1976). Outbound openness creates an obligation from the receiver to reciprocate in the future (Das & Teng, 2002; Knockaert et al., 2019; Narasimhan et al., 2009). Reciprocity demands that a firm assist (not deprive/injure) those who have assisted it, and the reciprocated assistance should be roughly equivalent (Flynn, 2003; Flynn & Yu, 2021). The norm of reciprocity regulates the exchange of resources among ecosystem firms, meaning that failure to discharge obligations may incur sanctions. Therefore, outbound openness creates reciprocal openness, which in turn encourages inbound flows from partners.

Second, a complementary line of reasoning assumes that outbound openness mediates the relationship between ecosystem interconnectedness and competitive advantage. As Narasimhan et al., (2009, p. 376) argue, “there may be inadequate short-term explicit rewards that are offset, to a degree, by long-term implicit rewards.” Since the benefits of social exchange neither have an exact price nor are measurable using a single quantitative medium of exchange, it is difficult to evaluate ecosystem firms' obligations on a transaction-by-transaction basis. Therefore, strict, tit-for-tat reciprocity during ecosystem strategy is not practicable. Outbound openness is thus not optimally based on formal market-based transactions, nor on calculations about equivalent reciprocity, but on some degree of sound social judgment and generosity.

Generosity is “a willingness to share one's resources in a plentiful or big-hearted way” (Rooney, 2015, p. 395) or giving more than one has received (Flynn & Yu, 2021; Klapwijk & Van Lange, 2009). Although interest in generosity is relatively new in innovation research, it is discussed in the sociology of knowledge and knowledge economy literature (Rooney et al., 2003). Recent research has considered it in ecosystem studies (Flynn & Yu, 2021; Jacobides, 2019; Jakobsen, 2020; Rapert et al., 2021; Rooney, 2015). For example, Jacobides (2019, p. 128) noted that success in ecosystems “involves helping other firms innovate,” and Jakobsen (2020), in line with the reciprocity argument implicit in social exchange theory, argues that firms who are generous to their partners in one area tend to receive the same generosity in return.

We argue that increased interconnectedness leads firms to adopt a more generous approach to knowledge sharing. As firms become more interconnected, members of different organizations will develop interpersonal relationships that are based on sharing knowledge (Lundmark & Klofsten, 2014). Such sharing is often generous, involving informal sharing of valuable knowledge (Dahl & Pedersen, 2004). Between highly integrated and interdependent firms, formal relationships among members of the different organizations become stronger and more trusting. That is, formal links between firms increase the likelihood that interpersonal relationships that promote generous sharing of knowledge will develop (Lundmark & Klofsten, 2014). Such relationships increase trust and, therefore, decrease transaction costs and ultimately strengthen a firm’s innovative performance (Tomlinson, 2010).

Through ecosystem interconnectedness, repeated acts of generosity that are more than instrumental such as endowing, gifting, or allowing outflow of productive resources to ecosystem partners in a munificent way (e.g., giving a rebate) may be a productive strategy. The underlying intent is to build trust, pull ecosystem partners in the direction of cooperation, and to invite participation beyond instrumental reciprocity. The norm of reciprocity stipulates that generosity begets generosity, i.e., responding to partners’ generosity in kind (Narasimhan et al., 2009). Furthermore, some reciprocators might try to elevate their status in the innovation ecosystem by reciprocating more openness than the initiator, i.e., offering greater value than that initially received (Flynn & Yu, 2021). Thus, a reinforcing spiral is created, positively affecting innovation through enhanced network effects (Dyer et al, 2018).

Third, outbound openness keeps ecosystem partners committed to growing and maintaining their own knowledge resources as well as the knowledge of partner firms. Generous outbound openness (e.g., offering licenses at below market prices or sharing knowledge informally) can motivate the receiving firm to stop investing in substitutes, thus keeping the buying partner connected to the ecosystem in general and the generous firm in particular (Narasimhan et al., 2009). Importantly, generosity signals an intention for a long-term, cooperative relationship that fosters trust. In other words, we can say that over and above reciprocity, generosity ties partner firms in long-term, trustful relationships that decrease the need for searching for substitutes, control measures, and scorekeeping. Consequently, generosity decreases frictions in exchanges and thus reduces transaction costs (Williamson, 1981).

Fourth, in social lock-ins (such as ecosystems) social status and structure play a significant role in influencing the alliance relationships and the fluidity of intangible resource flows (Corno et al., 2000; Rooney et al., 2003). Outbound openness serves as a strategic lever upon which firms can strengthen their position in the ecosystem. By increasing resource sharing, the knowledge under one’s control is more likely to become central to innovation efforts in the ecosystem, thus making the firm a less fungible member. Furthermore, research shows that jointly generated ‘common benefits’ (vs. ‘private benefits,’ which we are not focusing on here) are distributed among partners (Dyer et al., 2018; Pfeffer & Salancik, 1978). Ecosystem firm that increases their outbound openness will be better positioned to appropriate a higher percentage of the value in ex-ante negotiations (See Dyer et al., 2018; Barney, 1991; Pfeffer & Salancik, 1978). Further, a strong position translates into getting preferential access to unique resources during perilous endeavors.

Fifth, outbound openness strengthens the innovation ecosystem in competition against rival ecosystems. Since knowledge spans organizational boundaries and resides at the level of an ecosystem and because multiple ecosystems coexist in the economy, this requires a shift in strategy to rethink competition from ‘within-ecosystem’ to ‘across-ecosystems’ (Cennamo and Santaló, 2013; Jacobides et al., 2018). This macro-level competitive strategy sharpens the focus on unique value propositions that rival ecosystems cannot offer. Generosity and outbound openness elevate inter-firm collaboration, which increases network effects and relational rents,Footnote 1 thus generating a rising tide that lifts all boats.

In summary, we have argued that outbound openness mediates the relationship between ecosystem interconnectedness (measured by two proxies: interdependence and integration) and competitive advantage. Outbound openness triggers reciprocity that allows better alignment of interdependencies and integration of innovation resources. Further, we suggested that outbound openness provides strategic benefits that positively impact competitive advantage, such as developing trust, strengthening one’s membership in the ecosystem, keeping partners committed to the ecosystem and to one’s knowledge resources, decreasing transaction costs, and elevating the overall competitiveness of an innovation ecosystem. In a nutshell, by increasing interconnectedness with other ecosystem partners, firms will increase their outbound openness as the ties between firms and the people in them become stronger, which facilitates knowledge outflows. Outbound openness has a positive effect on a firm’s competitive advantage not only because it facilitates reciprocal sharing, but also because it increases the commitment to the sharing firm’s knowledge resources among other ecosystem firms, it reduces transaction costs, and strengthens the ecosystem upon which the firm depends.

We therefore hypothesize:

Hypothesis 3

Outbound openness mediates the positive relationship between interdependence and competitive advantage even controlling for the reciprocal effect on inbound openness.

Hypothesis 4

Outflow openness mediates the positive relationship between an ecosystem firm’s integration and competitive advantage even controlling for the reciprocal effect on inbound openness.

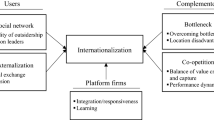

Our hypothesized model is shown in Fig. 1.

Method

Data

We used field surveys to collect data from two business hubs: Macquarie Business Park (MP), Australia, and Silicon Valley (SV), USA, with the help of two separate Qualtrics teams. We incentivized participation by providing an option of charitable donations for each respondent. Participants were also assured their individual and firm identities would not be disclosed. Thus, all analyses were conducted on anonymized data. Pilot studies (MP n = 36, and SV n = 32) were launched before data collection from the main sample that provided preliminary support for the feasibility of our approach. In the main study, 4,865 managers from MP and 5,215 from SV attempted the online questionnaire. To target the most suitable respondents (managers from ecosystem firms), screening questions were placed in the online surveys regarding the firm’s operation (must be B2B), size (min 500 employees), and working context (innovation ecosystem). The vast majority (MP = 4069, and SV = 4709) were eliminated as they did not meet the criteria.

We collected responses from managers (individuals) reporting on the behavior and performance of their firms, which is the most common approach to measure higher-level phenomena in organizational sciences (González-Romá, & Hernández, 2022; Hartmann et al., 2021; Mell et al., 2022; Rousseau, 1985). To control for respondent-level biases, we controlled for factors such as education level, social embeddedness, and hierarchical rank. Such demographic variables are known to affect respondents’ perceptions of the constructs under study (Kim, 2004; Xu et al., 2019). We also used two attention check items randomly interspersed within the survey that asked respondents to select “strongly agree” and “strongly disagree” for these items (Dacin et al., 2010). These attention checks further washed out 372 MP and 136 SV participants. Ultimately, we derived a sample of 794 managers (424 MP and 370 SV; response rate: MP 8.7% and SV 7.1%), shown in Table 1.

Since we used a single data collection source, we took steps to address the risks of common method bias (Podsakoff et al., 2003). We used an appropriate instrument design for data collection (Kim et al., 2016; Nguyen et al., 2018; Podsakoff et al., 2003). Our two attention check items (as marker variables) were theoretically uncorrelated with the study variables. Studies have shown that using this technique keeps the respondents more attentive during the survey (Dacin et al., 2010) and curtails common method variance (Lindell & Whitney, 2001; Nguyen et al., 2018). To test for evidence of common method variance (CMV) influencing our results, we conducted Harman’s single-factor test using all items in unrotated factor analysis (Podsakoff et al., 2003). The extracted factor accounted for less than 50% variance (42%), indicating limited risks of CMV skewing our results. Furthermore, as Gaskin (2012) and Gaskin and Lim (2017) recommended, we ran two CFA models, with and without the common latent factor, and then compared the standardized regression weights. The difference between path loading for some items was more than a 0.2 threshold (Gaskin, 2012), which means that these paths could be affected by CMV. To mitigate the risk of CMV, we used the common methods bias-adjusted composites for our analyses by leaving the common latent factor within the measurement model (Gaskin, 2012; Gaskin & Lim, 2017).

Measures

To test our model hypotheses, we borrowed validated scales from prior researchers (See Appendix A for items). Some items were slightly adapted to fit our study context (Kim et al., 2016). Overall, the survey contained a total of 39 items comprising two ‘attention checks’ (Dacin et al., 2010), seven demographic items, and 30 main items administered through a response scale ranging from 1 (Strongly Disagree) to 7 (Strongly Agree). We asked survey respondents to indicate their level of agreement with the items.

Ecosystem Interconnectedness

We operationalized ecosystem interconnectedness as a compendium of ecosystem firms’ interdependence and integration that were measured through eight items. Interdependence was measured through four items borrowed from Ganesan (1994). Example items include ‘External resources are crucial to our future performance.’ Integration was measured by four items adapted from Zaheer et al. (2013), for example, ‘My company integrates partner firms in R&D.’

Inter-firm Openness

Two dimensions of inter-firm openness were measured through seven items adapted from Cheng and Huizingh (2014): inbound openness (four items) includes ‘All our innovation projects are highly dependent upon the contribution of external partners.’ Outbound openness (three items) includes ‘We make every possible use of our intellectual properties to benefit our firm and help partners.’

Competitive Advantage

We used 15 items to measure four dimensions of product innovation that contribute to a firm’s sustainable competitive advantage: (1) Innovativeness—“the level of novelty of the resulting innovations” (Cheng & Huizingh, 2014). Innovativeness was measured through five items, i.e., three items were adapted from Cheng and Huizingh (2014), one item from Lin (2007), and one item from Lonial and Carter (2015). Example items include ‘Most of our innovations involve technologies that make old technologies obsolete.’ (2) Efficiency—a firm’s ability to produce a given or greater value faster and using minimal resources. A total of three items measured efficiency, i.e., two items were adopted from Lonial and Carter (2015), and one item from Lin (2007). Example items include ‘We are usually first-to-market with new products.’ (3) Responsiveness—the ability of a firm to reply to changing market conditions. We used four items to measure responsiveness—three items were adapted from Lonial and Carter (2015), and one item from Cheng and Huizingh (2014). Example items include ‘We respond quickly to changes in our customers’ product needs than competitors.’ 4) Quality—a firm’s excellence in product development/delivery—was measured through 3 items adapted from Pemartín et al. (2018). Example items include ‘Our new product is of superior quality than before.’

Descriptive Statistics

Table 2 outlines descriptive statistics, Cronbach’s alpha reliability estimates, and bivariate zero-order correlations. While some variables exhibit moderate-to-high correlation, we conducted a collinearity diagnostic test, which revealed that the variance inflation factor (VIF) ranged from 1.4 to 2.2. The mean VIF was within the recommended limits, i.e., lower than a conventional threshold of 10 (Kumar & Zaheer, 2019). Therefore, multicollinearity was not a concern (Salmerón et al., 2018; Xu et al., 2019). Examination of residual and scatter plots satisfied data normality and homoscedasticity (Hair et al., 2010).

Construct Validity and Reliability

We determined the psychometric properties of our reflective scales using recommended procedures (Bagozzi et al., 1991; Hinkin, 1998). We used confirmatory factor analysis to analyze convergent validity, internal consistency, and composite reliability. The alpha coefficient and composite reliability values were higher than 0.70, and the average variance extracted exceeded 0.50 (Bagozzi et al., 1991). Standardized loadings of items were greater than 0.50 and statistically significant (p < 0.05). These statistics indicate the reliability, validity, and consistency of the scales. We assessed discriminant validity to examine the extent to which every item of a construct is unique and does not measure other constructs. Towards this aim, we constructed alternate models by merging correlated dimensions and conducted a series of CFAs to examine the model fit indices. In all instances, there was a significant change in chi-square values (Δχ2 at p < 0.001). Moreover, changes in CFI values were ≥ 0.01, with a significant drop in model fit (El Akremi et al., 2018). Overall, we found support for our theorized baseline model to yield better results than alternative models, which establish discriminant validity (Bagozzi et al., 1991; El Akremi et al., 2018).

Results and Analysis

Direct Effects

To examine direct effects, we conducted hierarchical multiple regression with ‘Competitive advantage’ as our dependent variable. Hierarchical regression analysis is not only useful to control for confounding effects of demographic variables, but it also allows examination of the unique predictive capacity of each dimension separately beyond and above other predictors in a nested model (Kumar & Zaheer, 2019; Lankau & Scandura, 2002; Xu et al., 2019). We test four models at an alpha of 0.05 significance level by adding variables to a previous model. Model 1 was run for control variables; Model 2 comprises the direct relationship between social engagement dimensions (interdependence and integration) and competitive advantage; Model 3 includes the direct relationship between inbound openness and competitive advantage; and Model 4 examines the direct relationship between outbound openness and competitive advantage. This procedure enables us to analyze if each of our theorized constructs and their distinct dimensions show a significant improvement in competitive advantage R2 after accounting for the previous predictor(s) at every analysis stage.

Results are provided in Table 3. In Model 1a and 1b, we entered control variables (education gender, age, job experience, and position) that jointly explain 4.1% of the variance in perceived competitive advantage. Results show that the addition of ecosystem interconnectedness subconstructs (Model 2a and 2b) exhibits a significant change in the R2(ΔR2 = 0.43, F = 319.6, p < 0.01), accounting for 43% of explained variance in an ecosystem firm’s competitive advantage. This is because ecosystem firms’ interdependence (β = 0.34, p < 0.01) and integration (β = 0.32, p < 0.01) are significantly and positively related to competitive advantage.

In Model 3a, the addition of inbound openness further enhanced the explained variance in competitive advantage by 3.8% (ΔR2 = 0.038, F = 60.94, p < 0.01). These results corroborate the argument that a firm’s inbound openness is significantly and positively related to competitive advantage. Finally, in Model 4a, we include outbound openness while controlling for the impact of inflows. This model exhibits a statistically significant change (β = 0.32, p < 0.01). Results indicate that outbound openness is positively and significantly related to competitive advantage even when controlling for resource inflows. Specifically, outbound openness accounted for 3.2% of explained variance in an ecosystem firm’s competitive advantage.

In Model 3b, we repeated the above procedure but this time we added outbound openness, which enhanced the explained variance in competitive advantage by 5.8% (ΔR2 = 0.058, p < 0.01). These results support our conjecture that a firm’s outbound openness is significantly and positively related to competitive advantage. Finally, in model 4b, we include inbound openness while controlling for the impact of outbound openness. Results (ΔR2 = 0.012, F = 20.74, p < 0.01) indicate that inbound openness accounted for 1.2% explained variance in an ecosystem firm’s competitive advantage. Notably, Table 3 (model 4a) shows that while controlling for the effect of inbound openness, outbound openness significantly explains 3.2% of variance in competitive advantage with higher regression weight and power (β = 0.204, F = 54.71, p < 0.01). On the other hand, in Model 4b, when we controlled for the effect of outbound openness, inbound openness significantly explains less than half (1.2%) the variance in competitive advantage with lower regression weight and power (β = 0.138, F = 20.74, p < 0.01). These results speak to the relative importance and more substantial direct effect of outbound openness compared to inbound openness on competitive advantage in an innovation ecosystem context.

Indirect Effects

We examined the indirect effect of ecosystem interconnectedness on competitive advantage mediated by inbound openness (H1 and H2) and outbound openness (H3 and H4) using structural equation modeling based on bootstrapped bias-corrected 95% confidence intervals (Preacher & Hayes, 2008; Cheung & Lau, 2008; Rucker et al., 2011). The results are provided in Table 4. First, for inbound openness, there is evidence of significant partial mediation. Partial mediation occurs when both direct and indirect effects are significant (Rucker et al., 2011). When the direct path is significant, researchers also recommend assessing the variance accounted for (VAF) (Hair et al., 2014). According to Hair et al. (2014), a VAF value between 20 and 80% (as in our case) shows partial mediation. Our data show that both sub-dimensions of ecosystem interconnectedness (interdependence and integration) directly impact competitive advantage (Interdependence: β = 0.34, p < 0.01 and Integration: β = 0.32, p < 0.01) as well as indirectly through inbound openness (Interdependence: β = 0.31, p > 0.01 and Integration: β = 0.22, p > 0.05). Both direct and indirect effects are significant. Thus, inbound openness partially and significantly mediates the positive impact ecosystem interconnectedness has on competitive advantage in support of H1 and H2. As Rucker et al. (2011) argue, “In the case of partial mediation, there is a clear implication that other indirect effects could (and probably should) be examined and tested empirically.” Accordingly, we also examined the mediating role of outbound openness in the relationship between ecosystem interconnectedness and competitive advantage. Results show that outbound openness partially, positively, and significantly mediates the impact of interdependence on competitive advantage (β = 0.16, p < 0.01) as well as the positive impact of integration on competitive advantage (β = 0.17, p < 0.01) in support of H3 and H4.

In sum, Tables 3 and 4 show that both subconstructs of ecosystem interconnectedness (interdependence and integration) as well as mediating variables (Inbound and outbound openness) are reliable predictors of competitive advantage, i.e., significant direct effect. Furthermore, inbound openness and outbound openness partially mediate the positive impact that interdependence and integration have on competitive advantage. Theoretically, we can say that the positive effect of ecosystem interconnectedness on competitive advantage is partially explained by its effect on inbound and outbound openness. While the positive mediating role of inbound openness is well understood (and established) in the literature, our results also support the mediating role of outbound openness. In other words, outbound sharing of knowledge resources strengthens competitive advantage even if this does not result in immediate reciprocal inflows and even when outflows are shared below the fair market value to benefit partners.

Model Fit

To establish whether our theorized model sufficiently fits the data, we examined the structural model using four model fit indices recommended by Kline (2005): first, the chi-square test (χ2/df < 3.0, at p ≤ 0.05 thresholds) predicts that nested model fits the data set; second, the comparative fit index (CFI ≥ 0.90) shows least discrepancy between sample parameters and the theorized model; third, the standardized root mean square residual (SRMR < 0.08) indicates that the square root of the difference between the residuals of sample covariance matrix and the hypothesized model have acceptable values; and last, the root mean square error of approximation (RMSEA < 0.08) suggests that a model with its parameters is parsimonious yet fits well with the population's covariance matrix. The structural path model shown in Fig. 2 converged without iterations and all four indices are within an acceptable range (χ2 = 1548, df = 392, χ2/df = 3.9, CFI = 0.91, SRMR = 0.06, RMSEA = 0.06), indicating that our theorized model fits the data (Kline, 2005).

Discussion

Our results show that inbound and outbound openness mediate the positive relationship between interconnectedness and competitive advantage of ecosystem firms. Our results invite us to think more clearly, systematically, and creatively about the strategic role of outbound openness, and more broadly about the role of ethical climate (Cullen et al., 1993) in inter-firm networks. While generosity and outbound openness have permeated innovation practice, they are not widely discussed in innovation research. The tacit message in our data is that a firm seeking competitive advantage through increasing their interconnectedness with other ecosystem firms must be open to both inflow and outflow of knowledge resources. Challenging the view that giving knowledge resources erodes a firm’s competitiveness, we theorize that a firm’s outbound openness positively impacts the competitive advantage of an ecosystem firm.

Importantly, we found empirical evidence to support our theorizing that the direct effect of outbound openness on competitive advantage remains significant even controlling for the effect of reciprocal resource inflow. These findings have important theoretical implications for understanding the role of ethics in cultivating the social conditions necessary for open innovation ecosystems and inter-firm interaction generally. Next, we discuss these implications and their relevance to managerial practice.

Theoretical Implications

It is important to note that the theorizing and empirical testing in this study specifically applies to ecosystem firms. Nevertheless, some of the suggested mechanisms such as trust-building, decreasing transaction costs, and increasing partner commitment to the knowledge base under one’s control could apply, albeit with reduced magnitude, to more rudimentary forms of partnerships. The extent to which our theorizing applies in other types of partnerships depends on the nature of those partnerships, as well as the relative importance of outbound openness for strengthening relationships (e.g., building trusts and decreasing transaction costs), strengthening the team (e.g., helping complementors improve), and strengthening one’s position in the partnership. Thus, while we have demonstrated positive effects of outbound openness (while controlling for effects in inbound openness) only in an ecosystem setting, this study resonates with theoretical claims that firms can benefit significantly from virtuous behavior (Donada et al., 2019; Vera & Rodriguez-Lopez, 2004).

A central contribution of our study is to the open innovation ecosystem literature. We show that both inbound openness and outbound openness partially mediate the relationship between ecosystem interconnectedness and competitive advantage. Indeed, a significant partial mediation effect is known to have significant implications for theory building as it provides insights into the mechanisms underpinning established relationships while suggesting the plausibility of additional mechanisms (Preacher & Hayes, 2008; Rucker et al., 201). Inbound openness (getting resources) undoubtedly intensifies the relationship between ecosystem interconnectedness and competitive advantage, but this alone is not enough in interdependent environments in which innovation requires collaboration among multiple partners. Our investigations of the innovation hubs in Silicon Valley and Macquarie Business Park reveal that outbound openness does not erode competitive advantage but strengthens it. Furthermore, our findings contribute to research on open innovation by underscoring the positive role of generosity in sharing knowledge resources with ecosystem partners. Thus, an especially important contribution of our model is that it bridges the business ethics literature and the open innovation literature by highlighting that firms can do well by doing good.

Our findings also advance the network perspective on innovation ecosystems. Over the past three decades, in a series of ground-breaking studies on networks, social scientists have discovered that structural holes (disconnections between partner firms) exist in social networks (Burt, 1992; Burt et al., 2013; Ahuja, 2000; Bizzi, 2013; Kumar & Zaheer, 2019; Obstfeld, 2005). This body of literature argues that a network structure replete with structural holes is more likely to offer high-quality information to innovating firms. Prior theory and research indicate that access to and spanning structural holes positively impact a firm’s innovation performance (Ahuja, 2000; Kumar & Zaheer, 2019). A firm that spans structural holes in its network gains access to both more knowledge sources, as well as more diverse information, compared to a firm that spans fewer structural holes (Burt, 1992; Uzzi & Dunlap, 2005).

Extant theorizing of structural holes underscores the logic of ‘tertius iungens’ or ‘third who rejoices’ from knowledge brokerage—occupying a bridging position between disconnected others in a network—leading to advantageous consequences, such as innovation growth and profitability (Bizzi, 2013; Burt et al., 2013; Halevy et al., 2019; Uzzi & Dunlap, 2005). According to Burt’s (1992) theory, by bridging two unconnected others, a firm becomes capable of maneuvering and filtering information to gain access to superior information. In other words, a brokering firm derives gains from bridging two previously unconnected firms (Bizzi, 2013). Brokers gain advantage if they obtain and keep the information to themselves, built on the assumption of inbound openness, independence among actors, manipulation, and playing them off against one another, thus promoting the idea of adversarial relationships (Bizzi, 2013; Obstfeld, 2005). However, the logic of our theorizing and findings indicates that deliberate efforts at managing self-serving structural holes may have a negative effect on the ecosystem. Based on our findings, ecosystem firms may play a more magnanimous role in connecting nodes in a network rather than a brokerage role. While selfish logic (inbound openness) may be advantageous for independent firms, it provokes friction when it comes to ecosystem firms, who are, in fact, interdependently pursuing collective goals. To the extent that the relay position of the broker hampers optimal knowledge flows, structural holes may have some positive effects on the broker, but they may have negative effects on the ecosystem that may feed back to the broker. While the creation of brokerage linkages is consistent with the logic of our theorizing, the norms of reciprocity, greater interdependence, and integrated activities display clear tensions with behaviors that seek to maintain structural holes, at least when direct knowledge flows would be more efficient. Thus, the network structures require ethical considerations similar to those relating to more general knowledge sharing behaviors.

It is important to emphasize that our study does not suggest that ecosystem firms can disregard the risks of sharing resources. Outbound openness carries the risk of imitation, and it may benefit recipient firms at the expanse of the originator (Almirall & Casadesus-Masanell, 2010). However, our study indicates that the value, rarity, inimitability, and non-substitutability of knowledge resources and capabilities are entrenched in a constellation of multilateral relationships and values. Our results suggest that a firm’s competitive advantage in innovation ecosystems is not only about keeping rivals at bay, but also, and perhaps predominantly, about developing trust, strengthening one’s membership in the ecosystem, keeping partners committed to knowledge resources under one’s control, decreasing transaction costs, and elevating the overall competitiveness of an innovation ecosystem. Given that firms are sharing resources with partners rather than rivals, the aggregate benefits of resource outflows in the shape of showcasing a firm’s expertise, opportunity recognition, creating product value, and open, trustworthy, and generous relationships may often be larger than the possible costs from the risk of resource imitation. Due to social complexity and causal ambiguity, a focal firm’s relationships are challenging and costly to imitate (Clarke & MacDonald, 2019). Thus, it is difficult for rivals to replicate the focal firm’s open, trusting, and generous relationships (Dyer et al., 2018). Imitation becomes extremely difficult when there is a high degree of resource interdependence because one partner’s activity reinforces the other, which presents a complex system to rivals.

Managerial and Policy Implications

The first take-away from our findings is that policymakers, while designing ecosystem strategy, should know that ecosystem firms are rowing out to sea in the same lifeboat. Although a hub firm (founding firm) often sets the ecosystem’s rules and standards (Jacobides et al., 2018), power and control are, nevertheless, somewhat distributed. Every partner involved in the product innovation process retains residual control and claim over shared resources. Ecosystem firms have some control over each other’s goal fulfillment (Pfeffer & Salancik, 1978). Because innovation success greatly depends on involvement from all resource providers (Adner, 2017; Jacobides, 2019), there is still some truth to the idea that there is a pie to divide. Therefore, managers in ecosystem firms must know how to navigate a balance between creating value and capturing it. This would require, as our data suggest, considerable attention to the configuration of the social and ethical climate of inter-firm relationships and strategies that strengthens partnerships in the ecosystem (Adner, 2006; Hannah & Eisenhardt, 2018; Kapoor & Lee, 2013; Knockaert et al., 2019; Nagle, 2018).

Another insight suggested by our study is the strategic benefits of outbound openness in gaining the trust of partner firms and other stakeholders including non-firm participants such as governments, research universities, and not-for‐profit firms. As discussed earlier, innovation ecosystems are dynamic and purposive multi-stakeholders networks built on trust, co-creation of value, and exchange of complementary technologies. The extent to which a firm develops this social and reputational capital is dependent on its commitment to outbound openness and to do so generously. Our study suggests that generosity and outbound openness help a focal firm develop trustworthiness, reputation, and confidence of institutions and partners, thus securing a solid position within the ecosystem. Furthermore, these members’ (non-firm participants) support is deemed critical to implementing a more integrated approach to ecosystem management in decision-making and adding efforts to address a range of functional challenges. This allows preferential access to unique external resources such as government data, technology, expertise, and financial resources to mobilize the implementation of open innovation strategies. Our results (Tables 3) suggest to policymakers that ceding valuable resources to ecosystem partners on a relational rather than a strict market-value basis and flexible terms might be a useful innovation strategy. Finally, our data suggest that generosity and outbound openness will keep users (ecosystem partners) committed and motivated to remain dependent on the focal firm’s knowledge resources for their long-term benefit rather than looking for alternate sources.

On the other hand, innovation managers should understand that openness has downsides. Although there are potential synergies through resource complementarity between ecosystem firms, there is also potential for information overflow (Arora et al., 2016), and for resources to converge (i.e., they become obsolete or redundant), thereby diminishing complementarity (Dyer et al., 2018). Therefore, it is possible that alliances with ‘stale or too similar’ partners can be expensive and counterproductive due to, for example, high costs, over embeddedness, ego-networks, and social lock-ins, leading to reduced innovation (Arora et al., 2016; Kumar & Zaheer, 2019).

Limitations and Future Research

This study is subject to some limitations that highlight future research directions. First, while best efforts were made to collect comprehensive data in two countries, we cannot vouch for its representativeness to the larger population. Our survey data from both innovation hubs represent developed economies (USA and Australia). However, firms in developing markets (and countries) may have different interdependencies and openness strategies due to socioeconomic conditions. Exploring innovation ecosystems in developing countries provides a fruitful avenue for further research. Second, prior research indicates that innovation performance has an inverted U-shaped relationship with both inter-firm trust (Villena et al., 2019) and inter-firm openness (Boudreau, 2010; Laursen & Salter, 2006). It means that an optimum level of trust-based openness spurs innovation advantage. Identifying the optimum level of trust and openness, therefore, is a promising research direction.

Third, there is the potential for simultaneity between the predictors and criterion variables, which can overstate our cross-sectional estimates. Although consistent empirical evidence from two countries increases our confidence in our findings, future research should use time-lagged correlations and longitudinal design to address the causality issue. Fourth, we used screening questions regarding firm size, business type, and setting (to ensure a clean sample of managers that operate in innovation ecosystem context), and individual-level control variables such as manager age, gender, position, and experience to eliminate respondent biases. However, we did not control for which role or position a firm takes in the ecosystem. For example, outbound openness can differ for firms depending on whether they are a hub firm, supplier of complementary services, or sub-supplier. Because we could not correct for such endogeneity, our analyses do not support direct causal attributions. This limitation is significant since our results challenge a traditional tenet of strategic management theory about competitive advantage. Future studies should therefore take a firm’s role into consideration. Fifth, inter-firm openness may also vary with industry. One cannot rule out that differences between the outflow openness of pharmaceuticals, software, and IT are due to the nature of their product/service and industry culture. Other factors such as asset specificity, centrality in the ecosystem, and firm’s age might account for some unexplained variance in our study. Future studies should use these variables as controls for more reliable predictions. Last, our use of bias adjusted composites for data analyses may have gone some way to alleviate CMV, however, it does not fully eliminate the risk of common method bias. Future research should take more concrete steps to further reduce the sources of bias, for example, time-lagged measures as suggested above, using multiple respondents per firm, or by using archival data to triangulate data.

In conclusion, this study takes some initial steps towards exploring the positive role of generosity and outbound sharing of knowledge resources in innovation ecosystems. We found evidence that outbound openness is a positive mediator in the relationship between interconnectedness and competitive advantage of ecosystem firms. This has important implications for the study of business ethics as it shows that outbound openness is not a matter of helping others at one’s own expense. Rather, outbound openness is a mechanism for doing well by doing good. We hope that with our study, we have set the stage for further research on inter-firm openness that will continue to inform theory and practice alike.

Notes

relational rents—“the difference between the value created in a particular alliance and the value created in the next highest competing alliance or market relationship” (Dyer et al., 2018: 3141).

References

Adner, R. (2006). Match your innovation strategy to your innovation ecosystem. Harvard Business Review, 84(4), 98.

Adner, R. (2017). Ecosystem as structure: An actionable construct for strategy. Journal of Management, 43(1), 39–58.

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Administrative Science Quarterly, 45(3), 425–455.

Alam, M. A., Rooney, D., & Taylor, M. (2022a). From ego-systems to open innovation ecosystems: A process model of inter-firm openness. Journal of Product Innovation Management., 39(2), 177–201.

Alam, M. A., Rooney, D., & Taylor, M. (2022b). Measuring inter-firm openness in innovation ecosystems. Journal of Business Research, 138, 436–456.

Alexy, O., West, J., Klapper, H., & Reitzig, M. (2018). Surrendering control to gain advantage: Reconciling openness and the resource-based view of the firm. Strategic Management Journal, 39(6), 1704–1727.

Almirall, E., & Casadesus-Masanell, R. (2010). Open versus closed innovation: A model of discovery and divergence. Academy of Management Review, 35(1), 27–47.

Arora, A., Athreye, S., & Huang, C. (2016). The paradox of openness revisited: Collaborative innovation and patenting by UK innovators. Research Policy, 45(7), 1352–1361.

Bagozzi, R. P., Yi, Y., & Phillips, L. W. (1991). Assessing construct validity in organizational research. Administrative Science Quarterly, 421–458.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research—Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51(6), 1173–1182.

Benitez, G. B., Ayala, N. F., & Frank, A. G. (2020). Industry 4.0 innovation ecosystems: An evolutionary perspective on value cocreation. International Journal of Production Economics, 228, 107735.

Bizzi, L. (2013). The dark side of structural holes: A multilevel investigation. Journal of Management, 39(6), 1554–1578.

Blau, P. M. (1964). Exchange and power in social life: Transaction Publishers.

Blok, V., & Lemmens, P. (2015). The emerging concept of responsible innovation. Three reasons why it is questionable and calls for a radical transformation of the concept of innovation. In Responsible innovation 2 (pp. 19–35). Springer

Bogers, M., Chesbrough, H., & Moedas, C. (2018). Open innovation: Research, practices, and policies. California Management Review, 60(2), 5–16.

Bogers, M., Sims, J., & West, J. (2019). What is an ecosystem? Incorporating 25 years of ecosystem research. Academy of Management Proceedings. August 9–13, Boston.

Boudreau, K. (2010). Open platform strategies and innovation: Granting access vs. devolving control. Management Science, 56(10), 1849–1872.

Brattström, A., & Faems, D. (2020). Interorganizational relationships as political battlefields: How fragmentation within organizations shapes relational dynamics between organizations. Academy of Management Journal, 63(5), 1591–1620.

Burt, R. S. (1992). Structural holes. Harvard University Press.

Burt, R. S., Kilduff, M., & Tasselli, S. (2013). Social network analysis: Foundations and frontiers on advantage. Annual Review of Psychology, 64, 527–547.

Cheng, C. C., & Huizingh, E. K. (2014). When is open innovation beneficial? The role of strategic orientation. Journal of Product Innovation Management, 31(6), 1235–1253.

Chesbrough, H., Lettl, C., & Ritter, T. (2018). Value creation and value capture in open innovation. Journal of Product Innovation Management, 35(6), 930–938.

Chesbrough, H. (2006). Open innovation: A new paradigm for understanding industrial innovation. In H. Chesbrough, W. Vanhaverbeke, & J. West (Eds.), Open innovation: Researching a new paradigm (pp. 1–12). Oxford University Press.

Cheung, G. W., & Lau, R. S. (2008). Testing mediation and suppression effects of latent variables: Bootstrapping with structural equation models. Organizational Research Methods, 11(2), 296–325.

Chun, J. S., Shin, Y., Choi, J. N., & Kim, M. S. (2013). How does corporate ethics contribute to firm financial performance? The mediating role of collective organizational commitment and organizational citizenship behavior. Journal of Management, 39(4), 853–877.

Clarke, A., & MacDonald, A. (2019). Outcomes to partners in multi-stakeholder cross-sector partnerships: A resource-based view. Business & Society, 58(2), 298–332.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 128–152.

Corno, F., Reinmoeller, P., & Nonaka, I. (2000). Knowledge creation within industrial systems. Journal of Management and Governance, 3(4), 379–394.

Cullen, J. B., Victor, B., & Bronson, J. W. (1993). The ethical climate questionnaire: An assessment of its development and validity. Psychological Reports, 73(2), 667–674.

Dacin, M. T., Munir, K., & Tracey, P. (2010). Formal dining at Cambridge colleges: Linking ritual performance and institutional maintenance. Academy of Management Journal, 53(6), 1393–1418.

Dahl, M. S., & Pedersen, C. Ø. R. (2004). Knowledge flows through informal contacts in industrial clusters: Myth or reality? Research Policy, 33(10), 1673–1686.

Das, T. K., & Teng, B.-S. (2000). A resource-based theory of strategic alliances. Journal of Management, 26(1), 31–61.

Das, T. K., & Teng, B.-S. (2002). Alliance constellations: A social exchange perspective. Academy of Management Review, 27(3), 445–456.

Dattée, B., Alexy, O., & Autio, E. (2018). Maneuvering in poor visibility: How firms play the ecosystem game when uncertainty is high. Academy of Management Journal, 61(2), 466–498.

Davis, J. P. (2016). The group dynamics of interorganizational relationships. Administrative Science Quarterly, 61(4), 621–661.

Donada, C., Mothe, C., Nogatchewsky, G., & de Campos Ribeiro, G. (2019). The respective effects of virtues and inter-organizational management control systems on relationship quality and performance: Virtues win. Journal of Business Ethics, 154(1), 211–228.

Dyer, J. H., Singh, H., & Hesterly, W. S. (2018). The relational view revisited: A dynamic perspective on value creation and value capture. Strategic Management Journal, 39(12), 3140–3162.

El Akremi, A., Gond, J. P., Swaen, V., De Roeck, K., & Igalens, J. (2018). How do employees perceive corporate responsibility? Development and validation of a multidimensional corporate stakeholder responsibility scale. Journal of Management, 44(2), 619–657.

Emerson, R. M. (1976). Social exchange theory. Annual Review of Sociology, 2(1), 335–362.

Fassin, Y. (2012). Stakeholder management, reciprocity and stakeholder responsibility. Journal of Business Ethics, 109(1), 83–96.

Flynn, F. J. (2003). How much should I give and how often? The effects of generosity and frequency of favor exchange on social status and productivity. Academy of Management Journal, 46(5), 539–553.

Flynn, F. J., & Yu, A. (2021). Better to give than reciprocate? Status and reciprocity in prosocial exchange. Journal of Personality and Social Psychology, 121(1), 115.

Friedman, M. (2007). The social responsibility of business is to increase its profits. In Corporate ethics and corporate governance (pp. 173–178). Springer

Ganesan, S. (1994). Determinants of long-term orientation in buyer-seller relationships. The Journal of Marketing, 1–19.

Gaskin, J. (2012). Common method bias using common latent factor. Retrieved from http://www.youtube.com/watch?v=Y7Le5Vb7_jg&feature=youtu.be

Gaskin, J. and Lim, J. (2017). CFA tool. In: AMOS Plugin.

Giarratana, M. S., & Mariani, M. (2014). The relationship between knowledge sourcing and fear of imitation. Strategic Management Journal, 35(8), 1144–1163.

González-Romá, V., & Hernández, A. (2022). Conducting and evaluating multilevel studies: Recommendations, resources, and a checklist. Organizational Research Methods, 10944281211060712.

Grant, A. (2013). A revolutionary approach to success: Give and take. Penguin Group.

Gustafsson, C. (2005). Trust as an instance of asymmetrical reciprocity: An ethics perspective on corporate brand management. Business Ethics: A European Review, 14(2), 142–150.

Hair, J.F., Anderson, R.E., Babin, B.J. and Black, W.C. (2010). Multivariate data analysis: A global perspective: Pearson Upper Saddle River, NJ.

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2014). A Primer on partial least squares structural equation modeling. Sage.

Halevy, N., Halali, E., & Zlatev, J. J. (2019). Brokerage and brokering: An integrative review and organizing framework for third party influence. Academy of Management Annals, 13(1), 215–239.

Hannah, D. P. and Eisenhardt, K. M. (2018). How firms navigate cooperation and competition in nascent ecosystems. Strategic Management Journal.

Hartmann, S., Weiss, M., Hoegl, M., & Carmeli, A. (2021). How does an emotional culture of joy cultivate team resilience? A sociocognitive perspective. Journal of Organizational Behavior, 42(3), 313–331.

Harvey, C., Gordon, J., & Maclean, M. (2021). The ethics of entrepreneurial philanthropy. Journal of Business Ethics, 171(1), 33–49.

Henkel, J., Schöberl, S., & Alexy, O. (2014). The emergence of openness: How and why firms adopt selective revealing in open innovation. Research Policy, 43(5), 879–890.

Hinkin, T. R. (1998). A brief tutorial on the development of measures for use in survey questionnaires. Organizational Research Methods, 1(1), 104–121.

Iansiti, M., & Levien, R. (2004). The keystone advantage: What the new dynamics of business ecosystems mean for strategy, innovation, and sustainability. Harvard Business School Press.

Jacobides, M. (2019). In the ecosystem economy, what’s your strategy? Harvard Business Review, 97(5), 128–137.

Jacobides, M., Cennamo, C., & Gawer, A. (2018). Towards a theory of ecosystems. Strategic Management Journal, 39(8), 2255–2276.

Jakobsen, S. (2020). Managing tension in coopetition through mutual dependence and asymmetries: A longitudinal study of a Norwegian R&D alliance. Industrial Marketing Management, 84, 251–260.

Kapoor, R., & Lee, J. M. (2013). Coordinating and competing in ecosystems: How organizational forms shape new technology investments. Strategic Management Journal, 34(3), 274–296.

Kathan, W., Hutter, K., Füller, J., & Hautz, J. (2015). Reciprocity vs. free-riding in innovation contest communities. Creativity and Innovation Management, 24(3), 537–549.

Kim, H., Kankanhalli, A., & Lee, H. (2016). Investigating decision factors in mobile application purchase: A mixed-methods approach. Information & Management, 53(6), 727–739.

Kim, S. (2004). Individual-level factors and organizational performance in government organizations. Journal of Public Administration Research and Theory, 15(2), 245–261.

Klapwijk, A., & Van Lange, P. A. (2009). Promoting cooperation and trust in" noisy" situations: The power of generosity. Journal of Personality and Social Psychology, 96(1), 83.

Kline, R. B. (2005). Principles and practice of structural equation modeling. Guilford Publications.

Knockaert, M., Deschryvere, M., & Lecluyse, L. (2019). The relationship between organizational interdependence and additionality obtained from innovation ecosystem participation. Science and Public Policy.

Kumar, P., & Zaheer, A. (2019). Ego-netwok stability and innovation in alliances. Academy of Management Journal, 62(3), 691–716.

Lankau, M. J., & Scandura, T. A. (2002). An investigation of personal learning in mentoring relationships: Content, antecedents, and consequences. Academy of Management Journal, 45(4), 779–790.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131–150.

Lin, H.-F. (2007). Knowledge sharing and firm innovation capability: An empirical study. International Journal of Manpower, 28(3/4), 315–332.

Lindell, M. K., & Whitney, D. J. (2001). Accounting for common method variance in cross-sectional research designs. Journal of Applied Psychology, 86(1), 114.

Lonial, S. C., & Carter, R. E. (2015). The impact of organizational orientations on medium and small firm performance: A resource-based perspective. Journal of Small Business Management, 53(1), 94–113.

Lundmark, E., & Klofsten, M. (2014). Linking individual-level knowledge sourcing to project-level contributions in large R&D-driven product-development projects. Project Management Journal, 45(6), 73–82.

MacKinnon, D. P., Fairchild, A. J., & Fritz, M. S. (2007). Mediation analysis. Annual Review Psychology, 58, 593–614.

McCubbrey, D. J. (2009). Business fundamantals: A global text. Retrieved from http://196.43.161.4/bitstream/handle/123456789/76/McCubbrey%2C%20Don%20-%20Business%20Fundamentals.pdf?sequence=1&isAllowed=y

Mell, J. N., van Knippenberg, D., van Ginkel, W. P., & Heugens, P. P. (2022). From boundary spanning to intergroup knowledge integration: The role of boundary Spanners’ metaknowledge and proactivity. Journal of Management Studies. https://doi.org/10.1111/joms.12797

Meyer, M. (2015). Positive business: Doing good and doing well. Business Ethics: A European Review, 24, S175–S197.

Mingers, J. (2011). Ethics and OR: Operationalising discourse ethics. European Journal of Operational Research, 210(1), 114–124.

Nagle, F. (2018). Open source software and firm productivity. Management Science, 1–25.

Narasimhan, R., Nair, A., Griffith, D. A., Arlbjørn, J. S., & Bendoly, E. (2009). Lock-in situations in supply chains: A social exchange theoretic study of sourcing arrangements in buyer–supplier relationships. Journal of Operations Management, 27(5), 374–389.